Here are some alternative energy stocks that are off at least 50% from their highs, yet would appear to have years of high growth potential ahead of them.

Flywheel Technology energy storage company has proven that 25 flywheels can store and deliver a megawatt of energy, and in recent tests has shown how ten of its new flywheels operating as one system can store and flow one megawatt. Down to $1.14 from a high of just 2.49, this little known green stock may in future years play a crucial role in steadying energy flows.

First Solar (FSLR)

The undisputed global market leader in the solar photovoltaics industry, FSLR designs and manufactures solar panels utilizing thin film semiconductor technology; cadmium telluride used to convert sunlight into electricity. The one medium term concern is tellurium supply, but with the shares at 127.43 (down from a high of 317), one may be staring at an opportunity to own the next Google.

Comverge Inc. is a clean energy company with substantial revenues, from providing peaking and base load capacity to electric utilities, grid operators and associated electricity markets. At 4.15 the stock is off 85% from its high. I don't know much about this company but am fascinated by the steepness of the drop, as the firm has revenue and cash in the bank. Worth looking into.

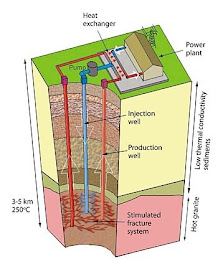

Ormat Technologies (ORA)

A true American success story, at 27.42, ORA shares are down over half from a high of 57.93. ORA develops, owns and operates geothermal power and recovered energy-based electricity power plants in the United States and renewable geothermal power plants in other countries around the world, and sells the electricity generated by these plants. Much of the equipment utilized is designed and maunfactured by Ormat.

AMSC supplies electrical systems used in wind turbines; sells power electronic products that regulate wind farm voltage to enable their interconnection to the power grid; licenses wind energy system designs to manufacturers of such systems, and provides consulting services to the wind industry, At 14.20 (down from 47.53), the shares present an interesting entry point for access to a wind-related stock with explosive revenue growth.

Leading USA company is a major provider of wind power, solar energy, water desalination / purification and other emerging technology systems and services. At 20.65, the stock is down by half, trades at a P/E of 9.7 and yields 6%!

Applied Materials (AMAT) Inc.

High quality USA clean energy technology company offering the SunFab thin film solar line of photovoltaic electricity systems. Based in Santa Clara, California, AMAT yields 1.92% at today's close of 12.47 and trades at a reasonable P/E of just 15.

No comments:

Post a Comment